This article was written to help you save money like a professional or like your nagging mother has always wanted you to save. To help you out, we compiled the 11 finance apps that are time-tested favorites amongst finance gurus. These apps will help making saving money easy.

Over the last 18 months, we’ve seen the economy come to complete standstill and then come roaring back, only to be slowed again by the Delta variant.. Most of us are clutching our finances a little tighter and looking for ways to maximize our savings.

Whether you’re looking to learn about investing or you simply want help to save money in an emergency fund, there’s a finance app on this list for you.

1. MINT

Let’s start by introducing the king of strong budgeting and expense tracking. Mint, powered by Intuit (the company behind TurboTax and QuickBooks), is a powerful finance app for anyone who is interested in monitoring their net worth and spending.

It’s no surprise that this application boasts more than 15 million users. It’s simple but extremely effective for monitoring where every dollar goes. Plus, it comes with additional benefits like credit score monitoring, budget development, and asset tracking.

Although Mint won’t technically give you extra money, it will definitely help you save money. The tools it provides will closely monitor your savings and spending, allowing you to build smart financial habits.

Cost: FREE

2) SmartAsset

Ever wish you had a financial advisor in your back pocket, answering your money questions as they appear? Say hello to SmartAsset.

This finance app features award-winning tools and calculators that empower you to make the best financial decisions possible. You’ll receive access to expert advice that will help you save money, invest, and budget on a personal level.

SmartAsset even offers tailored advice to help you through this strange time and take on the coming potential recession with skill. They’re aware of all the relief efforts and options you have, and you can trust that they’ll steer you toward the smartest financial path.

Want to buy a house? Confused about taxes?

The local advisors you’ll match with at SmartAsset will serve as your personal guides.

Cost: Free with the option to pay for leads

3) Honeymoney

In these uncertain times, cash is the winner. We all want to boost our savings and feel safe during the pandemic and beyond.

Meet HoneyMoney, the finance app that’s totally centered around increasing your savings. It’s flexible, simple, but totally effective. Whether you use it online or on your phone, the app will teach you how much you can spend, what you should save, and where you can put away more money.

HoneyMoney is also excellent at helping users plan for the future. Set up financial goals and see all of your plans in one place so that you can determine how much you truly need to save. HoneyMoney is the app to help you save money fast.

Cost: $5/month or $50/year

4) Financial Gym

Many of us don’t think about our finances as a part of our health, but they are – and Financial Gym will put you in touch with the trainers you need to stay fit and happy.

Whether you’re paying off debt or striving to save for a house, this finance app will help you set up goals and crush them with hard work and education. Your BFF, or “best financial friend,” is there 24/7 to cheer you on and hold you accountable.

Financial Gym is perfect for those of you who have downloaded dozens of money apps but never been able to stick to one. Your coach won’t let you slip and will work with you quarterly to ensure you prepare for the financial future you want.

The experts at FG are so confident in their plan that they’ll give you your money back if you don’t experience successful results. If you’re not quite ready to commit, you can book a free 20-minute consultation to learn more.

Cost: $85/month for an advisory plan, $145/month for couples, and $35/month for students

5. Acorns

Investing is intimidating, especially if you’ve never dabbled in the stock market before. That’s why Acorns makes it easy for you to dip your toe in the water with spare change. Acorns is the finance app that will help you save money and invest fast.

This application is a blend of a robo-advising with an automated savings tool. For just a few dollars a month, you’ll learn to invest and slowly build yourself a little nest egg with minimal effort.

Just give Acorns permission to automatically invest your spare change and it will give you cash back at select retailers, as well as provide educational content. As your investments snowball into something bigger, you’ll continue to learn better investing habits and earn money at some of your favorite stores.

If you’re pretty comfortable investing, you’ll probably want an app that gives you more freedom with smaller high-balance account fees. On the other hand, if you’re a hands-off investor who struggles to save, this is a great way to actually begin your investing journey.

Cost: $1 to $3/monthly

6. Digit

Much like the Acorns app, Digit’s goal is to help you put away money over time by automating your savings. Its algorithm will help you determine what your “perfect” daily savings goal is, then pull that amount from your checking account and put it in savings.

This finance app is designed for one ideal customer: the person who has always struggle to save. Whether it’s because you don’t know how to or you can never stick to a goal, Digit is excellent at helping you build strong saving habits – and you barely even have to think about it.

To determine what you should be saving, Digit will analyze everything from your regular income to your upcoming bills and spending habits. Each ideal savings goal is crafted to fit individual needs and circumstances. There’s not a one-size-fits-all approach.

Cost: $5/month

7) Dobot

Dobot’s specialty is helping you align your goals with your current financial habits. The finance app will work with you to set up specific financial goals, then help you track your progress as you save. You can either automate your savings or do it on your own – whichever works best for you.

What’s great about Dobot is that you can choose from a variety of goal sizes and types. It doesn’t matter if you’re saving for an upcoming concert or a long-term goal like your child’s college fund – Dobot helps you save at your own pace.

Additionally, experts at Dobot will provide you with personalized advice to keep you on track and offer insights into your financial health.

Cost: FREE

8. Qapital

Want to set your own savings parameters? Qapital will let you do that. Instead of just rounding up to the nearest dollar, as you do with Chime and other applications, you can round up to the nearest $2 – allowing you to reach your savings goals even faster.

Qapital also offers fantastic reward goals. For instance, every time you do something like reach a certain FitBit goal or check an item off your TODoist list, you can save a little extra money. This is one of the only applications that actually works with other apps to get you little financial rewards for your own success.

This finance app is also excellent if you need to set some spending caps for yourself. Qapital will help you keep track of your limits and even transfer money into a savings goal every time you are able to withstand the temptation to spend too much.

Cost: Basic plan is $3/month and complete is $6/month

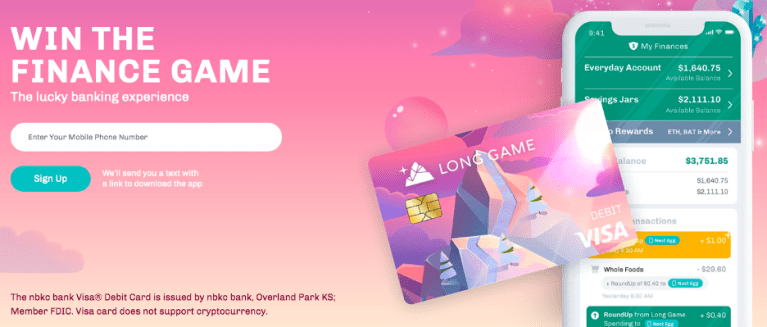

9) Long Game

When you play the game of money, you’re in for a long ride – and Long Game wants you to focus on that. The application will set up a new, FDIC-insured account where you can deposit money for your daily spending.

As you go about life, play the games on the app to win cash prizes. You can also use the app to set up custom savings goals, earn 0.1% interest on any savings, and withdraw cash when you need it.

Worried about losing money by experimenting with a new app? The best part about Long Game is that you won’t lose any money. You can withdraw your funds at any time and will never risk a single dollar, even when you play the featured games.

Cost: FREE

10) Tip Yourself

Ever wish you give yourself an extra dollar or two when you feel like you really deserve it? Look into Tip Yourself, the app that gives you that little boost when you most need it.

This money-saving application helps you manage your money while also tipping yourself every time you accomplish a task on your to-do list. It centers on the concept of positive reinforcement – users are rewarded financially when they do great work in real life.

Set up different tip jars for different saving goals and challenges. Each will be linked to your own checking account, where the app withdraws the money to add to your savings.

Over time, you’ll learn to build good habits and associate putting away a few dollars here and there with self-reward.

Cost: FREE

11) Chime

With no hidden fees, a quick sign-up process, and a fee-free overdraft up to $100, Chime really is the bank account of the future.

Backed by Bancorp Bank and FDIC-insured, this banking application offers free checking, savings, and debit card accounts. If you’re tired of seeing your checking account get hit with annoying fees on a regular basis, it might be time for you to switch to Chime.

Chime also helps you spot areas where you need a little extra cushion to avoid overdrawing from your account. You can also automate your savings, access ATMs wherever you go, and access 24/7 mobile support for all of your banking needs.

Avoiding bank fees, foreign transaction costs, and long waiting periods will save you money as you go about your regular banking activities. In a recession, a little bit saved goes a long way, so why not go with a bank that helps you keep every dollar?

Cost: FREE

In Conclusion

No one knows that the post-pandemic economy looks like, but we do know this: now is the time to grow your savings and improve your financial knowledge.

These finance apps will help you do just that, whether it’s through automated savings or budgeting tips and tricks. Give them a shot to see how you can maximize your net worth and feel secure during the coming weeks, months, or even years.